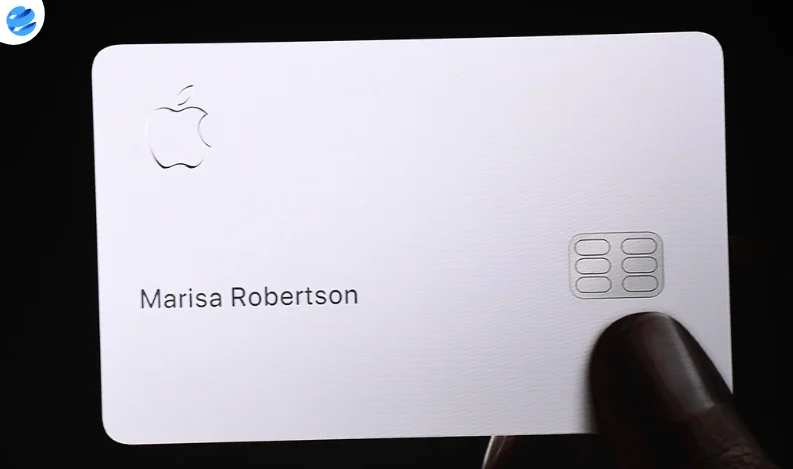

JPMorgan Chase is close to finalizing a deal to take over the Apple Card portfolio from Goldman Sachs, according to people familiar with the matter. If completed, the move would mark a significant shift in Apple’s financial partnerships and further solidify JPMorgan’s status as a leading credit card issuer in the United States.

The negotiations between JPMorgan and Apple have advanced in recent weeks as other potential partners, including American Express, Synchrony, and Barclays, have exited the process. All parties involved, JPMorgan, Goldman Sachs, and Apple, declined to comment publicly on the matter.

Goldman Sachs originally secured the Apple Card partnership in 2019, launching the product with significant expectations. However, the venture quickly proved more challenging than anticipated. The high growth of the Apple Card, coupled with stringent accounting rules that required Goldman to reserve funds for potential loan losses upfront, created unexpected financial strain.

At the end of March, Goldman Sachs reported $20.5 billion in credit card loans, a portion of which came from its Apple Card portfolio. The bank is also in the process of transitioning its General Motors card business to Barclays. For CEO David Solomon, stepping away from consumer lending, including the Apple Card, represents a strategic move to streamline operations amid internal pressure and broader concerns about rising loan defaults in the event of an economic downturn.

For Apple, transferring the card to JPMorgan would represent a return to stability after several years marked by rapid growth and regulatory scrutiny. Goldman Sachs had committed to servicing the Apple Card through 2029, but concerns over billing issues and refunds triggered investigations, adding complexity to the partnership.

JPMorgan, already the largest credit card issuer in the country by purchase volume, would add another high-profile product to its extensive portfolio. However, the bank is reportedly proceeding with caution. According to sources, JPMorgan is requiring certain concessions related to servicing standards and other operational terms before finalizing the deal.

If the agreement is signed, it would strengthen JPMorgan’s leadership in co-branded cards and reinforce its presence in the consumer finance space. The deal is also expected to benefit Apple, offering its users a more experienced card issuer amid ongoing growth in its financial services segment.

The Wall Street Journal was the first to report the advanced state of the discussions between Apple and JPMorgan.