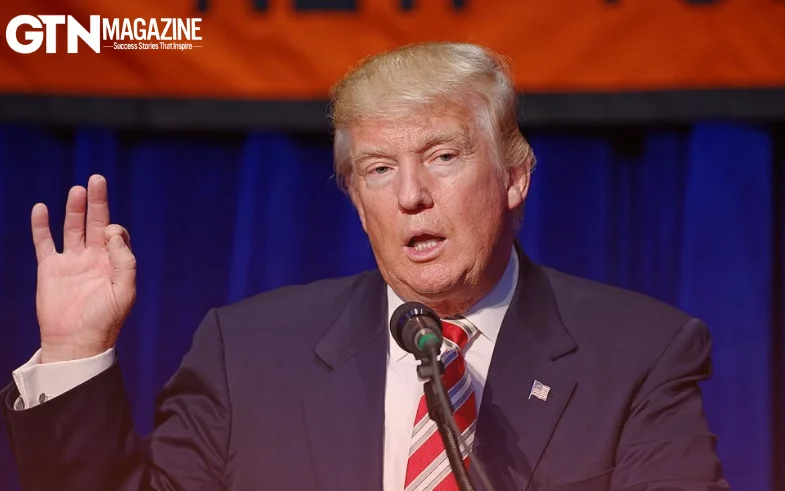

Washington: President Donald Trump said on Friday that U.S. oil companies are expected to invest at least $100 billion in Venezuela’s energy sector, backed by American security guarantees, following the removal of President Nicolás Maduro.

Trump made the remarks after meeting with executives from more than a dozen energy companies at the White House to discuss rebuilding Venezuela’s oil industry. Attendees included senior leadership from ExxonMobil, ConocoPhillips and Chevron, as well as representatives from Halliburton, Valero and Marathon.

“The oil companies will spend at least $100 billion to rebuild Venezuela’s energy sector,” Trump said. He added that the United States would provide protection to ensure companies “get their money back and make a very nice return.”

Trump said the U.S. government would decide which companies are allowed to operate in Venezuela and that agreements with oil producers could be finalized as early as Friday or shortly thereafter.

“One of the things the United States gets out of this will be even lower energy prices,” the president said.

An industry source told CNBC that the White House initiated the meeting and that it was not requested by the oil companies.

Venezuela’s oil potential and collapse

Venezuela holds the largest proven crude oil reserves in the world, estimated at 303 billion barrels, or roughly 17 per cent of global reserves, according to the U.S. Energy Information Administration.

Despite its vast resources, Venezuela’s oil industry has suffered years of underinvestment, mismanagement and sanctions. Output has fallen from around 3.5 million barrels per day in the 1990s to approximately 800,000 barrels per day today, according to data from energy consultancy Kpler.

Rystad Energy estimates that restoring production to 3 million barrels per day would require more than $180 billion in investment through 2040.

Chevron’s role and challenges for others

Chevron is currently the only U.S. oil major operating in Venezuela, through a joint venture with state-owned oil company Petróleos de Venezuela (PDVSA).

U.S. Energy Secretary Chris Wright said this week that the administration is working closely with Chevron, which continues to operate on the ground.

“Chevron is on the ground, so we’re getting daily updates,” Wright said in an interview with CNBC. He added that modest capital investments could lift Venezuelan output by several hundred thousand barrels per day in the short to medium term.

However, Wright acknowledged that ExxonMobil and ConocoPhillips face higher barriers to returning. Both companies exited Venezuela after former president Hugo Chávez nationalized oil assets in 2007. They later won arbitration cases against the Venezuelan government and still hold outstanding claims worth billions of dollars.

“We’ve had our assets seized there twice,” ExxonMobil CEO Darren Woods said. “To re-enter a third time would require some pretty significant changes from what we’ve historically seen.”

Wright said that while Venezuela’s outstanding debts to Exxon and Conoco remain unresolved, the Trump administration is prioritizing economic stabilization through renewed oil production.

Control of oil sales

The Trump administration has also taken control of Venezuela’s oil exports as part of its strategy, according to Wright. Venezuela will ship oil to the United States, where it will be sold by the U.S. government, with proceeds held in U.S.-controlled accounts.

“We need to have that leverage and that control of those oil sales to drive the changes that must happen in Venezuela,” Wright said.

Trump said earlier this week that revenue from the oil sales would be used to purchase American-made goods, including agricultural products, medicines, medical equipment and energy infrastructure.

“In other words, Venezuela is committing to doing business with the United States of America as their principal partner,” Trump wrote on social media.

Industry reaction remains mixed

While some independent oil producers have expressed strong interest in entering Venezuela, senior officials said major oil companies remain cautious.

Treasury Secretary Scott Bessent said on Thursday that large oil companies with board oversight are reluctant to move quickly.

“The big oil companies who move slowly are not interested,” Bessent said. “But independent producers and individuals, wildcatters, are calling nonstop. They want to get to Venezuela immediately.”

It remains unclear whether major U.S. oil companies will commit significant capital without long-term political stability and legal guarantees in Caracas.