New York: Bitcoin rebounded sharply on Friday, climbing back above the $70,000 level just a day after coming close to breaking below $60,000, as traders stepped back into risk assets following a turbulent sell-off.

The world’s largest cryptocurrency rose as much as 11% during the session, reaching an intraday high of $71,458 before easing slightly. It was last trading around $70,400 in afternoon dealings.

The rebound followed a steep decline on Thursday, when bitcoin slid nearly 15% in a single day and briefly fell below $61,000. The sell-off was driven by a combination of heavy outflows from exchange-traded funds and forced liquidations, amid broader volatility across global financial markets.

Despite Friday’s recovery, bitcoin remains well below its record high of more than $126,000 reached in October, leaving the asset down roughly 45% from its peak.

Broader Market Stabilisation

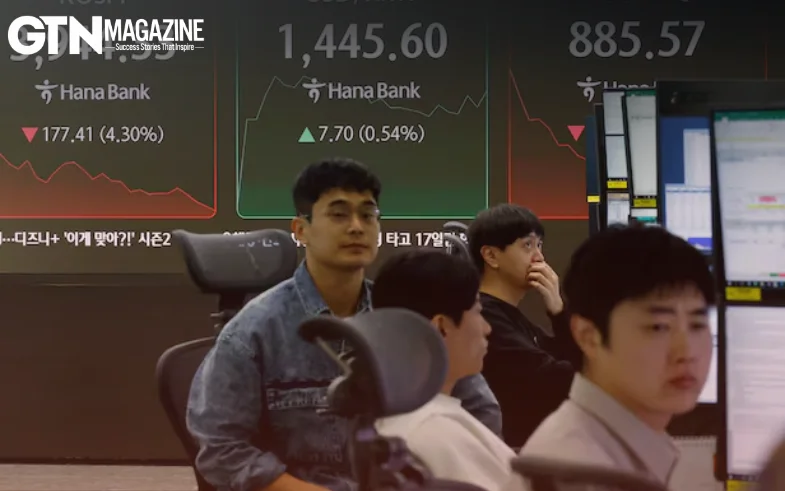

The turnaround in crypto markets came alongside a rally in equities, suggesting a tentative stabilisation after a volatile week. US stocks posted strong gains, with the Dow Jones Industrial Average rising nearly 2%, while the S&P 500 and the Nasdaq Composite each advanced more than 1%.

Investors rotated back into risk-sensitive assets as concerns eased over the impact of artificial intelligence on software companies. Several major technology stocks recovered sharply after heavy losses earlier in the week.

Cautious Outlook Persists

Market analysts cautioned that the rebound may not signal a sustained recovery. Some noted that bitcoin’s earlier break below $70,000 could still point to further downside in the coming months.

Analysts at 10X Research said the cryptocurrency could fall as low as $50,000 after a short-term stabilisation phase, warning that summer trading conditions could bring renewed pressure.

“I think we are going to have a counter-trend rally that may move sideways or bounce modestly,” Markus Thielen of 10X Research said. “But there is a risk that the market makes another low later in the year.”

For now, traders remain focused on whether bitcoin can hold above the $70,000 threshold, which has emerged as a key technical and psychological level following this week’s sharp swings.